Every year we are treated to the market prognosticator’s forecasts for the upcoming year. Invariably the forecasts don’t pan out as no one has access to the proverbial crysal ball. However, this doesn’t keep the pundits from trying as even a broken clock is correct twice a day. I’d like to suggest taking a more pragmatic view of the market by borrowing a common sense approach from Jack Bogle, founder of the Vanguard Group.

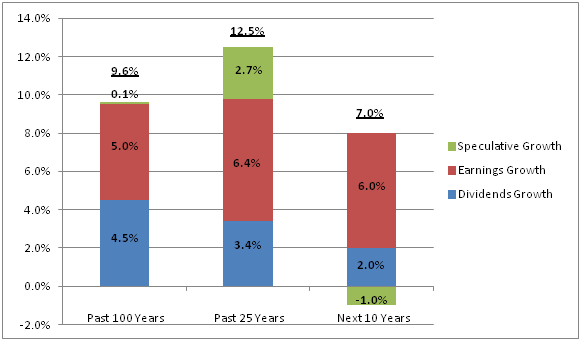

The actual return on stocks can be viewed as the sum of the following components: 1) Dividend yield, 2) Earnings growth, and 3) Speculative return. The dividend yield and earnings growth encompass the investment return whereas the speculative return is self evident. Over the last 100 years the stock market has produced an average annual return of 9.6%. The components of the 100 year average annual return are as follows: 1) Dividend yield – 4.5%, Earnings growth – 5.0%, Speculative return – .10%. Conversely, the stock market has produced an average annual return of 12.5% over the last 25 years. The components of the last 25 year average annual return are as follows: 1) Dividend yield – 3.4%, 2) Earnings growth – 6.4%, 3) Speculative growth – 2.7%.

Let’s now focus on what’s driving the 2.9% increase in the average annual return over the last 25 years. Investment return (dividend yield + earnings growth) comprises .30% of the growth and speculative return accounts for the remaining 2.6%. So for the most part, speculation has fueled the increase in average annual returns over the last 25 years. This now begs the question, “Should we expect the speculative return to persist when looking out to the future?” Jack Bogle would emphatically state “Don’t count on it!”

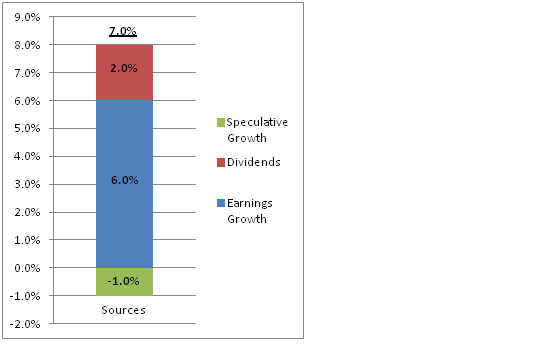

Now let’s apply what we know along with some common sense assumptions to approximate an average annual return for the next 10 years. We know current dividend yields are 2.0% which represents a (2.5%) reduction from the 100 year average of 4.5%. Earnings growth of 6.4% over the last 25 years has outpaced the 100 year average by 1.4%. Let’s assume the continual improvement in economic efficiency persists which yields an average earnings growth of 6%. The 2.7% increase in speculative return over the past 25 years is the by-product of a price earnings ratio that doubled from 9 times to 18 times. Common sense tells us that expecting the current price earnings ratio of 18 to double over the next 10 years is highly unlikely. More likely is the case in which the price earnings ratio reverts back towards 9 times. Let’s assume the price earnings ratio declines over the next 10 years which in turn yields an average speculative return of a negative (1.0%). So common sense tells us we should expect an average annual return of 7.0% for the next 10 years. The components of our estimated annual return for the next 10 years are as follows: 1) Dividend yield – 2.0%, 2) Earnings growth – 6.0%, 3) Speculative growth – (1.0%).

Figure 1 – Total Returns On Stocks, Past & Future

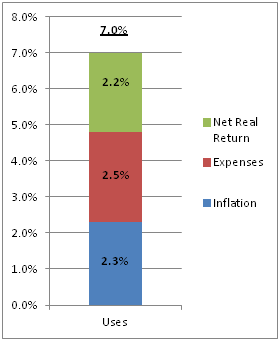

Next we turn to what Jack Bogle describes as the “Humble Arithmetic.” An investor will not receive the 7.0% market return we have approximated as the market participation costs (“Fund Costs”) must be deducted. Annual fund costs which include sales loads, expense ratios, and turnover costs currently run at about (2.5%) which would reduce the 7.0% market return to 4.5%. Increases in the rate of inflation must also be deducted from our approximated annual market return of 7.0%. If we assume an annual inflation rate of 2.3% our real return becomes a humble 2.2%.

Figure 2 – Next 10 Year Equity Returns – Sources

Figure 3 – Next 10 Year Equity Returns – Uses

Now that we have thoroughly depressed ourselves, what can we do with this information? Let’s focus on what we can control. We have the ability to control and minimize the market participation costs. We can simply choose not to participate in the wealth transfer from Main Street to Wall Street. Low cost, passively managed, tax efficient funds are a great place to start. Passively managed funds seek to replicate the market’s return rather than trying to beat it. So in our earlier market projection exercise, the passively managed fund would attempt to replicate our 7.0% annual return. This way we are assured of receiving the actual return the market is kind enough to dole out. The two low cost leaders of passively managed funds are Dimensional Funds Advisors (“DFA”), and the Vanguard Group. Thanks to fund providers like DFA and the Vanguard Group we have tools to help keep us on the path to realizing our investment goals.